Wall Street prepares to fleece Main Street again

Things are beginning to happen in the markets. People in the know can sense a change in the wind. Those people in the know are predators on Wall Street and they are prepared to pounce on their traditional prey - retail investors.

Wall Street is preparing for panic on Main Street.

Hedge funds are lining up to profit from potential trouble at some “alternative” mutual funds and bond exchange-traded funds that have boomed in popularity among retirees and other individual investors.

Financial advisers have pushed ordinary investors into those funds in search of higher returns, a strategy that has come into favor as Federal Reserve benchmark interest rates remain near zero. But many on Wall Street worry that junk bonds, bank loans and esoteric investments held by some of those funds will be extremely hard to sell if the market turns, leaving prices pummeled in a rush for the exits.

In this era of ZIRP (zero interest rates) everyone searched for greater yield. Because of the historically low interest rates, those yields could only be found in non-traditional, and more risky, places.

“They are going to be toast,” David Tawil, president of hedge fund Maglan Capital LP, said of the funds holding hard-to-sell assets like emerging-market debt and small-capitalization stocks. “It will be one of our first levels of shorting the moment we start to see cracks, because it’s ripe with retail, emotional investors.”

For months now Wall Street has been preoccupied with the lack of liquidity in the markets. An illiquid market means you can't sell easily, and if you do sell you "move the market price" by doing it. This has become pronounced because just a few huge players dominate the markets.

“Liquidity is generally poor in corporate bond markets and in the U.K. market it’s thin to zero,” said Mike Parsons, head of U.K. fund sales at JPMorgan Asset Management in London. “You don’t want to be in a gigantic fund where there’s potential for a lot of investors rushing for the exit at the same time. Smaller funds are more nimble.”

According to Royal Bank of Scotland Group, liquidity in the credit markets has dropped 90% since 2006. It isn't just corporate bonds. Government bonds have also become hard to sell.

Of course this doesn't actually mean much without some sort of trigger that would cause people to want to sell.

It turns out that the trigger is happening right now.

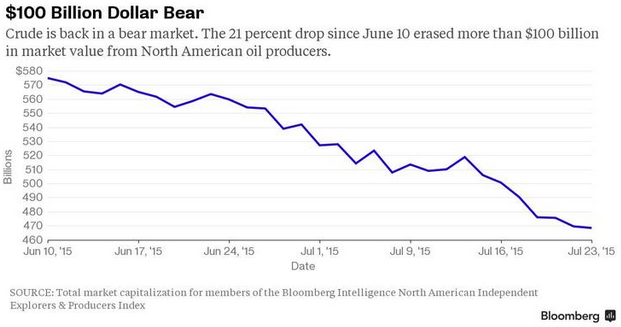

The commodities rout that’s pushed prices to a 13-year low pulled some of the biggest mining and energy companies below levels seen during the financial crisis...

“This commodity bear market is like a train wreck in slow motion,” said Andy Pfaff, the chief investment officer for commodities at MitonOptimal in Cape Town. “It has a lot of momentum and doesn’t come to a sudden stop.” Muted demand from other emerging markets and prospects for more oil supply are adding to the bearish sentiment that UBS Group AG strategist Julian Emanuel described as a “perfect storm.”

The Bloomberg Commodity Index is down almost 60 percent from its 2008 peak.

To put it simply, the last time commodities crashed like this, they did it just a few months before the entire financial system broke.

Does that mean we are going to see a repeat of 2008? Absolutely not. The dynamics are very much changed since then. For instance, the housing market has yet to see a top, unlike in 2008 when it topped more than a year previously. So those looking for a repeat are in for a surprise.

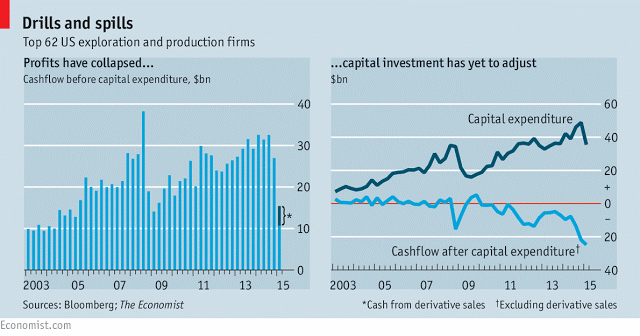

But that doesn't mean that thing won't turn nasty in the coming months. The most obvious place for the crunch to start is in the shale oil sector.

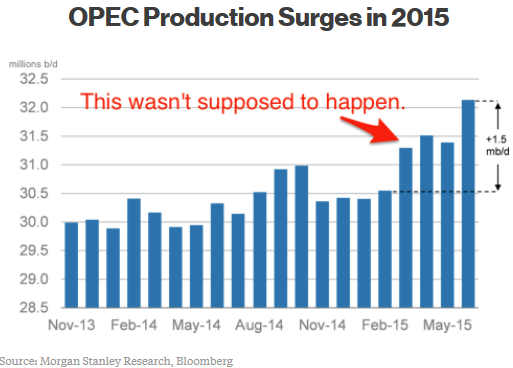

“The commodity price is telling the U.S. shale sector to shrink,” said Subash Chandra, an oil analyst at Guggenheim Securities LLC in New York. “Barrels from the U.S. are on a collision course with barrels coming out of Iran, Saudi Arabia and elsewhere.”

Energy producers in North America are cutting production, but it isn't happening fast enough. Several OPEC nations are increasing production in order to pay for wars.

For many shale producers, layoffs and bankruptcies are in their near future. For now, the capital markets have been generous, but that could change when their hedged contracts expire.

There are other troubling developments that could roil the markets, such as China committing 10% of their GDP to propping up a stock market bubble.

The dangers of a default by Puerto Rico is probably underestimated. Grexit remains the most likely outcome for Greece.

A new tech bubble is getting harder and harder to deny (but there is no shortage of people who will deny it).

Comments

Let the Good times Roll...

'Let me brush your rock and roll hair!'

IF you can afford to ride it out,

just remember that Wall Street never loses.

"Religion is what keeps the poor from murdering the rich."--Napoleon

Investors in CIA enterprises will probably make out like bandits

On the other hand, investors in CIA enterprises will probably make out like bandits.

http://techcrunch.com/2015/07/24/palantir-raises-450-million-now-valued-...